Your Go-To List of hard money lenders in Atlanta Georgia

Your Go-To List of hard money lenders in Atlanta Georgia

Blog Article

Checking out the Conveniences and Risks Related To a Hard Money Finance

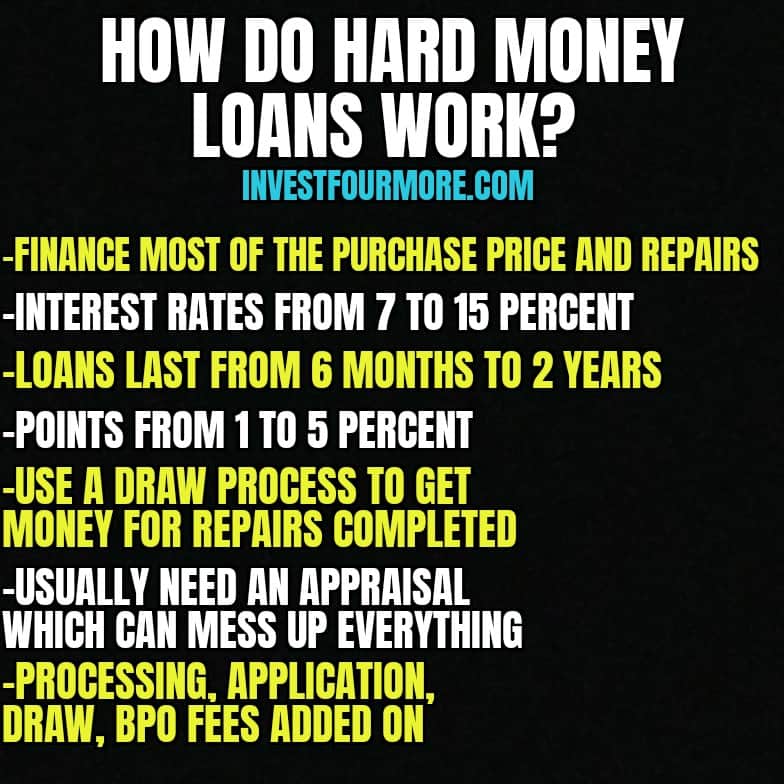

Navigating the complex globe of genuine estate funding, financiers commonly run into the alternative of a Hard Money Lending - hard money lenders in atlanta georgia. This alternative kind of financing, recognized for its quick approval process and versatile terms, can be a possible game-changer for those in urgent requirement of resources. Yet, care is suggested, as the high rates of interest and short payment durations can additionally lead to significant dangers. The vital depend on understanding these aspects, to make an educated decision on whether a Hard Money Loan fits one's economic strategy and threat resistance.

Recognizing the Essentials of a Hard Money Funding

What specifically is a Hard Money Loan? Unlike traditional financial institution financings, difficult Money car loans are based largely on the worth of the residential or commercial property being bought, instead than the borrower's credit rating score. These fundings are usually used for financial investment purposes, such as home flipping or growth tasks, rather than personal, domestic usage.

Secret Perks of Opting for Hard Money Loans

Potential Dangers and Disadvantages of Hard Money Lendings

Regardless of the attractive benefits, there are some substantial threats and downsides connected with tough Money car loans. These financings frequently include high rates of interest, in some cases double that of typical lendings. This can result in monetary pressure otherwise taken care of properly. Tough Money finances normally have much shorter payment periods, typically around 12 months, which can be challenging for consumers to satisfy. Additionally, these fundings are commonly safeguarded by the consumer's property. If the customer is unable to pay back the Loan, they risk shedding their building to repossession. Finally, hard Money lending institutions are less regulated than traditional lending institutions, which might expose borrowers to underhanded loaning practices. While tough Money lendings can give quick financing, they also lug significant threats.

Instance Scenarios: When to Consider a Hard Money Funding

Contrasting Tough Money Lendings With Other Funding Options

Just how do hard Money finances pile up versus other financing choices? When contrasted with traditional car loans, difficult Money lendings use a quicker from this source authorization and funding process due to fewer policies and requirements. They often come with greater rate of interest rates and costs. In contrast, small business loan supply reduced rate of interest prices however have rigid qualification standards and a slower authorization time. Exclusive loans, on the other hand, deal adaptability in terms however may lack the structure and security of difficult Money loans. Crowdfunding and peer-to-peer loaning systems use a distinct alternative, with competitive prices and convenience of gain access to, but might not be ideal for larger financing demands. Consequently, the option of funding depends upon the borrower's particular needs and conditions.

Final thought

In conclusion, tough Money financings offer a practical solution for actual estate investors needing swift and versatile funding, specifically those with credit report difficulties. Nevertheless, the high rate of interest and shorter settlement durations demand careful browse around these guys consideration of possible threats, such as repossession. It's necessary that borrowers extensively examine their economic method and danger tolerance before choosing for this sort of Finance, and compare it with other financing choices.

Unlike traditional bank loans, tough Money fundings are based mostly on the value of the home being bought, instead than the debtor's credit history rating. These lendings frequently come with high rate of interest prices, in some cases dual that of typical financings. In scenarios where a consumer wants sites to avoid a prolonged Loan procedure, the much more uncomplicated tough Money Lending application can supply an extra convenient alternative.

When compared with typical financings, difficult Money lendings use a quicker approval and funding process due to less laws and demands - hard money lenders in atlanta georgia. Exclusive fundings, on the other hand, deal flexibility in terms but might lack the framework and safety of hard Money loans

Report this page